The COVID-19 era was an inflection point for the global monetary order, one whose impact we are still navigating. Inflation and asset inflation are the two most well-known consequences, however, the impact of the COVID-19 era monetary policy (and the decades of decisions prior) go far beyond inflation headlines. Nowhere is this more evident than in the changing relationship between central banks and gold.

Record Gold Purchasing From Central Banks

In 2022, central banks made records with gold purchases, acquiring over 1,100 tonnes of the metal. This was the 12th consecutive year that central banks increased their gold holdings globally. This trend has continued into 2023 despite moderating inflation, due to concerns over the longevity of the current global monetary order.

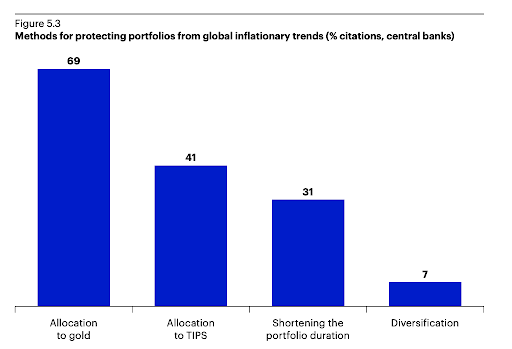

Invesco published the following survey of central banks, which demonstrated that 69% of central banks prefer gold as their strategy to protect against global inflationary trends.

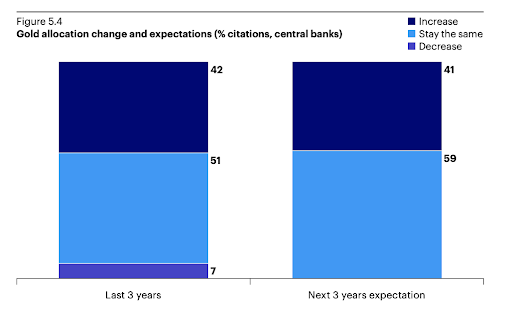

Over 40% of central banks expect their gold holdings to increase over the next three years, while the remaining central banks expect their gold holdings to stay constant. No central banks surveyed expected their gold holdings to decrease, compared to 7% of central banks who thought their gold holdings would decrease when surveyed over the last 3 years.

Gold As A Safe Haven Asset

One major theme for gold that is emerging, is gold as a ‘safe haven’ asset. Almost all central banks, 96%, cited gold’s status as a ‘safe haven’ asset as a reason for increasing their allocation.

It’s worth exploring the ramifications of this phrase. What does a safe haven asset mean in this context? It does not mean a hedge against inflation as central banks clearly identified their thinking in regards to inflation directly. To discuss gold as a safe haven asset is to position it as an alternative to the current monetary system, and as an asset that can provide portfolio protection if that system is challenged, weakens, or fails.

This likely signifies that central banks are concerned with potential tectonic shifts which are underway. Demand for an asset that does not have counterparty risk has grown following the precedent set by the US freezing Russian reserves. Close to 40% of central banks cited this as a concern which drove gold purchasing.

Another insight that can illuminate what a ‘safe haven’ asset means to central banks is the following quote published by Invesco in their report:

“Gold has played a crucial role during the last couple of years: We increased the exposure 8-10 years ago and had it held in London, using it for swaps and to enhance yields, but we’ve now transferred our gold reserves back to our own country to keep it safe – its role now is to be a safe-haven asset” said one central bank based in the West.

The only reason a central bank would take physical possession of gold they were previously comfortable holding via reputable providers in other countries is that they fear a breakdown in global trust. Gold is a safe haven in this context because it lacks counterparty risk, its value and acceptance are not extended to the owner by another sovereign nation.

Increasing gold holdings and repatriating gold previously held overseas are strong signals that central banks are concerned with a breakdown in trust and in the value of fiat currencies.

Is Dedollarisation Here?

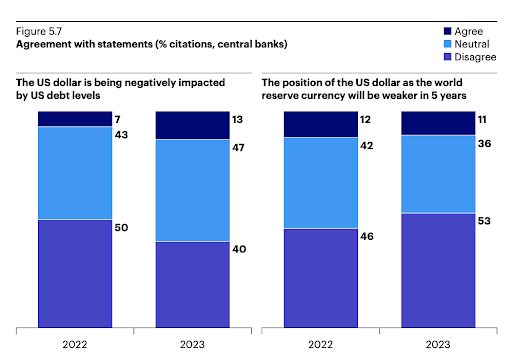

Dedollarisation is another major theme due to the impacts of inflation, the rise of BRICS, and exponentially growing debt levels. However, central banks do not share these concerns.

Only 10% of central banks surveyed truly believe the role of the US Dollar as a world reserve currency is being threatened here. It is worth noting that when central banks discuss the position of the US Dollar not being weaker, this doesn’t contradict their concern about inflation (which can also be seen as a ‘weakening’ of the dollar). In the former discussion, central banks are discussing the role of the US Dollar relative to other currencies, not relative to goods, services, assets, or gold. The US Dollar can both weaken against hard assets while remaining neutral or strengthening against other fiat currencies.

This observation by central banks is consistent with Tether’s observations. USD₮, our flagship US Dollar linked stablecoin, has seen record growth while stablecoins denominated in other fiat currencies have not. The demand for US Dollar denominated payments will likely remain high, even while people seek out protection from inflation and geopolitical instability in gold and Bitcoin.

However, one comment sticks out from a theme of general confidence in the role of the US Dollar:

“While the US dollar is expected to retain its dominance, central banks are increasingly exploring diversification into Emerging Market currencies to hedge against volatility”

Central banks are looking at a higher level of diversification into EM currencies as they anticipate increased volatility. To hedge against currency volatility means that central banks do see less stable conditions as a real possibility. This coincides with their positioning of gold as a safe haven asset. While they may believe the US Dollar maintains its role as a world reserve currency, they may also anticipate that conditions become much more volatile as confidence starts to wane and weaken or as more geopolitical shocks emerge.

Gold Throughout History

Gold has the longest track record of any monetary store of value, it has been used since time immemorial. Due to this, we can easily observe if gold has kept its value over time, not just over the last 10 years but over hundreds of years.

In 1913, when the Fed was created, an ounce of gold was worth roughly 27 barrels of oil. A barrel of oil was worth 80 cents and an ounce of gold 24 dollars. Remarkably, today the ratio is still the same!

Over this same time period, the dollar lost 98% of its value in oil terms.

Cicero, a Roman statesman, wrote in his memoirs circa 43 BC that with a coin containing an ounce of gold, you could buy an elegant toga, a belt and a pair of sandals in ancient Rome. As of today, 2000 years later, an ounce of gold allows you to buy a good quality suit, a belt and a good pair of shoes.

Another way to look at this is to examine wages over time. In 1964, the minimum wage was $1.25 per hour, which was 5 silver quarters. That silver value as of 2017 would have been $15.50. Remarkably, this is the minimum wage number that many activists settled on as constituting a ‘living wage’ and one that they argued should be the minimum wage.

The ratio between gold and various goods and services over time has remained remarkably constant. As vast swathes of history have passed since Cicero wrote his journals around 65 BC, there is absolutely no reason the same amount of gold should still buy a fine set of clothes, except that gold’s tether to value is driven by fundamental economic realities, rather than political whims.

Why Tether Gold Makes Gold Easier

For the average person, owning gold can be a hurdle. They must navigate the physical purchasing and storage of the gold. Few people want to hold a considerable quantity of such an easily identifiable asset such as gold in their home, however, storing it with a professional custodian can be expensive and difficult. Verification is also an issue, it is challenging for the average person to confirm they bought actual gold rather than a substitute metal plated in gold.

XAU₮ provides easily accessible, verifiable, gold on-demand with all of the benefits of blockchain. 1) XAU₮ can be transported with you anywhere you go using any compatible wallet 2) XAU₮ is divisible into increments as small as 0.000001 troy ounces of gold 3) XAU₮ can be bought and sold with ease 24/7, on several exchanges including Bitfinex, OKX, Huobi and many others. 4) XAU₮ can be redeemed for physical gold to any Swiss address or personally picked up from the vault 5) XAU₮ storage is as easy as storing any other crypto asset 6) XAU₮ can be verified and tracked at any time via the Tether Gold website 7) XAU₮ has no custodian fees XAU₮ is the easiest choice for the average person to increase their gold allocation, and for the crypto savvy it has the benefits of being stored alongside all of your other crypto assets. As global monetary conditions continue to change, central banks and institutional investors are increasingly seeking out hard assets and safe haven assets. Gold has a long history of serving both purposes.