In addition to pro-crypto policies, the widespread acceptance of cryptocurrencies necessitates a supporting infrastructure that enables public access to and exposure to the ecosystem. London is the most crypto-ready city in the world for businesses and start-ups, based on analyzing eight key variables involving taxation, ATMs, jobs, and events in the crypto space.

Going by the report from Recap’s recent research on leading crypto hubs around the world, one can unequivocally say that the vision of United Kingdom’s Prime Minister, Rishi Sunak, to “ensure the U.K. financial services industry is constantly at the forefront of technology and innovation,” is fast becoming a reality. This is because out of all cities in the world, London was found to have the highest crypto-readiness to attract enterprises and start-ups in 2023.

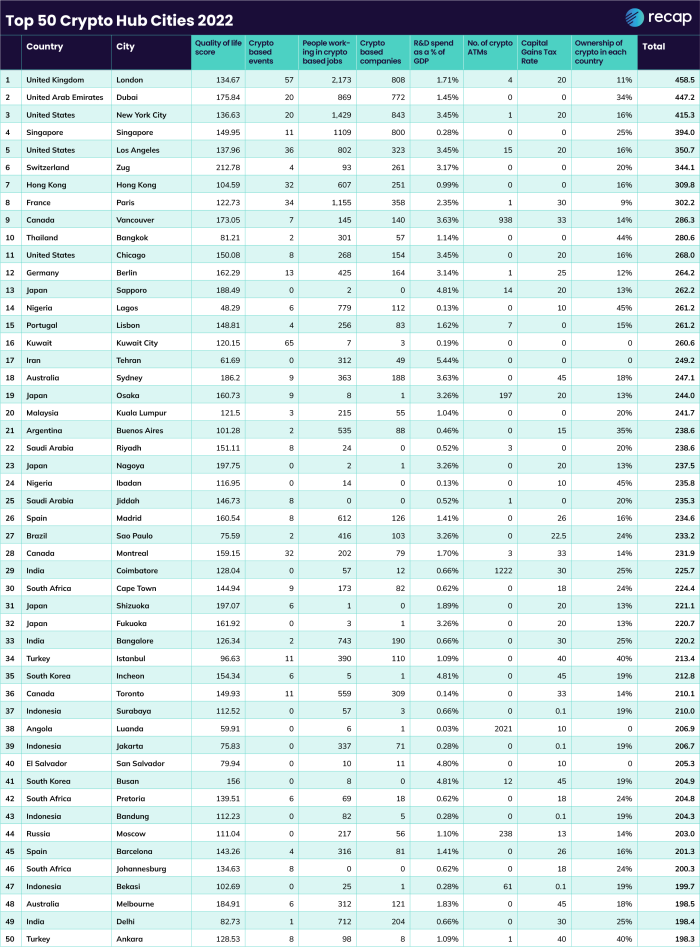

Recap came to this conclusion based on examining eight key relevant data points. They include the total number of crypto-specific events, crypto-related jobs, crypto-specific companies and the number of crypto ATMs. Other non-crypto factors were also considered, such as quality of life, research and development spending as a percentage of gross domestic product and capital gains tax rate. Despite other cities overshadowing London in some of the study metrics, overall, it beat them all. Matter-of-factly, the largest number of crypto-related occupations are located in London, indicating greater public interest in the cryptocurrency ecosystem.

As indicated in the table above, prominent metropolitan cities such as Dubai and New York made the list’s top three. However, Hong Kong, which was projected to be the most crypto-ready region in 2022, plummeted to seventh place.

Located on ReCap

The table above is a list that identifies the top 50 major cities having cryptocurrency-friendly infrastructure in the world.

London tops all the charts. In an effort to maintain leadership, the Bank of England and His Majesty’s Treasury have emphasized the necessity to create a central bank digital currency by 2030., and everyone is eager to see how things will unfold before then.

As per some sources, the “digital pound” roadmap is expected to be released by mid-February. It’s interesting to know that cash and coin payments in the United Kingdom decreased by 35% in 2020, indicating a shift toward cashless transactions.